Jan 08, 2023 08:25

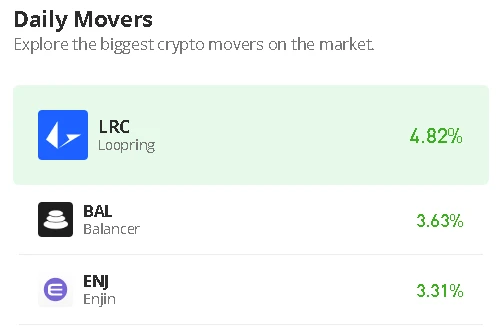

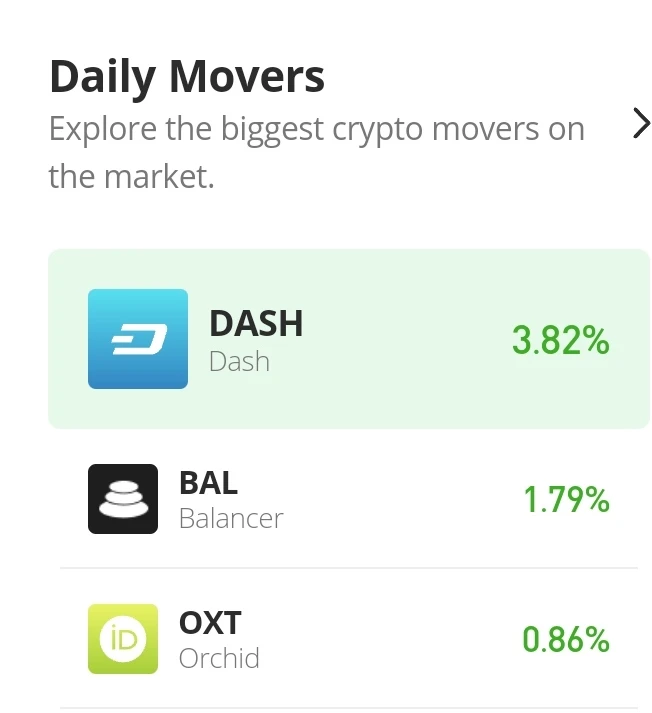

Balancer’s native token, BAL, appears to be holding up despite the platform’s ongoing security issues. On Friday, Jan. 6, the DeFi project tweeted a statement asking liquidity providers on its platform to withdraw their tokens from certain pools valued at $6.3 million. Via their official Twitter handle, the decentralized exchange stated there was a security risk that could not be resolved by the platform’s emergency DAO. Thus, they advised LPs to immediately remove their assets from all affected pools. Related Reading: Polkadot (DOT) Inks 10% Rally In Last 7 Days, Makes Case As ‘Non-Security’ Asset IMPORTANT: Because of a related issue, LPs of the following pools should remove their liquidity ASAP as the issue cannot be mitigated by the emergency DAO. https://t.co/WcBeBvjdY2 — Balancer (@Balancer) January 6, 2023 BAL Token Holds Its Ground For Now Earlier today, Balancer confirmed that 85% of the assets in those pools had been moved while still urging LPs to withdraw the remainder as they attempt to resolve the issue at hand. Interestingly, amid the ongoing problem of the decentralized exchange, several investors appeared to have retained their faith in the platform’s native cryptocurrency BAL. In the last 24 hours following Balancer’s warning, BAL has appeared unaffected, decreasing in value only by 0.13% based on data from CoinMarketCap. At the time of writing, the ERC-20 token is exchanging hands at $5.35, with its market cap value set at $248,354,921, representing only a 0.11% negative change over the last day. BAL trading at $5.34 | Source: BALUSD chart on Tradingview.com While it is still too early to determine the effect of the Balancer security problem on BAL’s market performance – especially with the details still unknown – these early signs show that BAL may pull through this period, and investors need not panic. Related Reading: MATIC Advances 6.5% In Last 7 Days – Can It Sustain Gains For Another Week? Is Balancer Experiencing Another Crypto Exploit? Like every coin in the cryptoverse, there is no given certainty on market patterns. While Balancer has not revealed the nature of the security risk and has assured the public of full disclosure after a successful mitigation, much speculation is still flying around the crypto community. Many suspect a smart-contract exploit as it won’t be the first the Ethereum-based DEX would fall victim to such. In August 2020, Balancer was hacked, leading to the loss of $500,000 worth of ETH. However, compared to 2020, when Balancer was still a budding crypto project, the DeFi protocol currently ranks as the fourth biggest decentralized exchange with a TVL value of $1.49 based on data from the DeFi analytics platform Defillama. If the current fears of exploitation are confirmed, the consequences may be quite drastic for a crypto market that is currently trying to recover after the crash of the FTX exchange late last year. In November 2022, FTX, formerly one of the biggest cryptocurrency exchanges, collapsed, causing the crypto market to lose billions of dollars. The crash was due to heightened leverage and solvency concerns about FTX’s trading arm Alameda Research, leading to many investors trying to withdraw their assets from the exchange simultaneously, which resulted in a liquidity crisis and, ultimately, bankruptcy. Featured Image: ICOnow.net, Chart from Tradingview.com