Worlds First Spot XRP ETF Debuts in Brazil, is U.S. Next

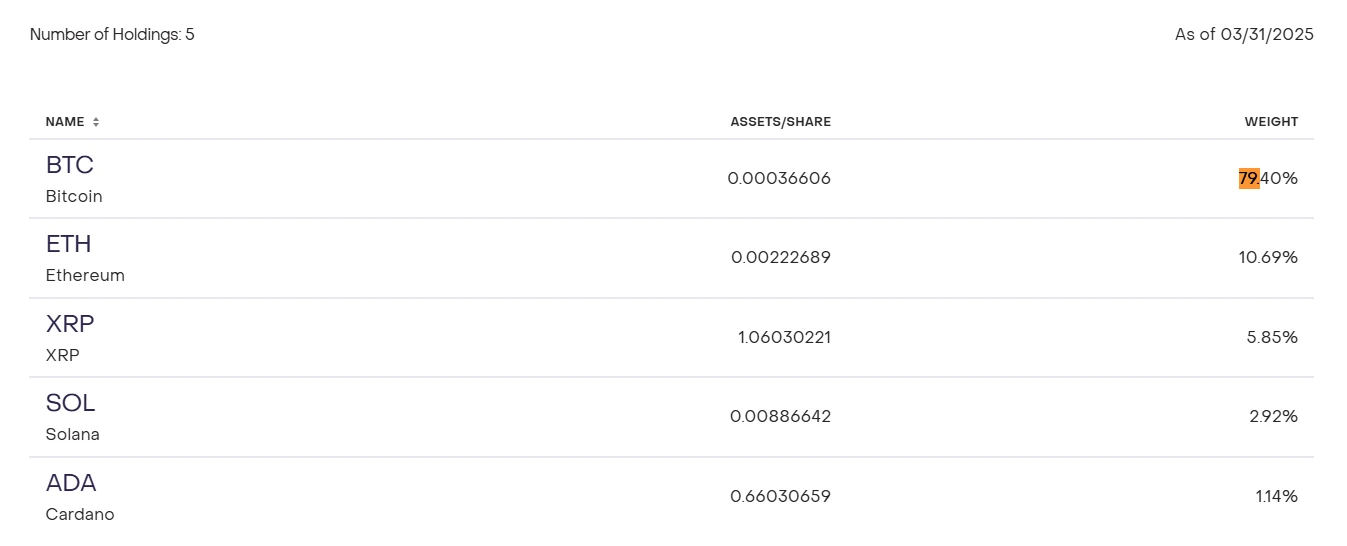

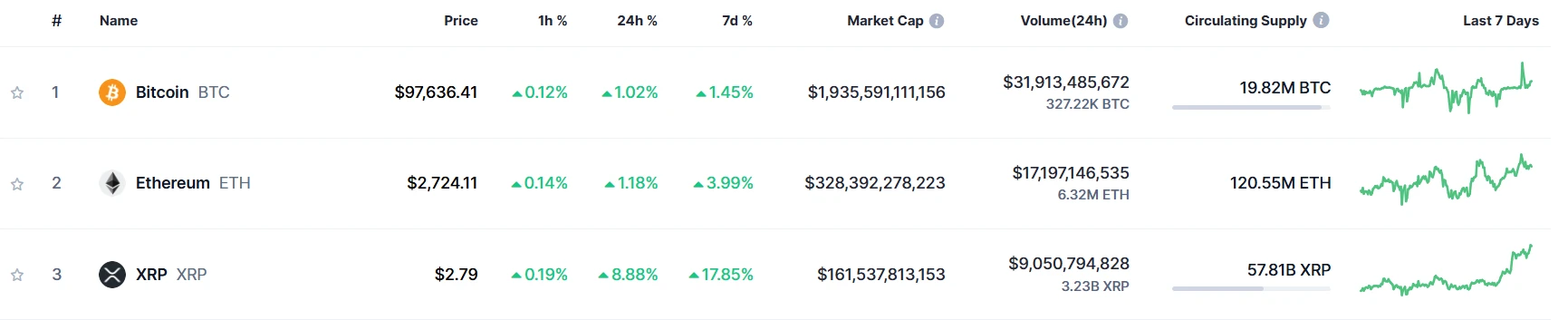

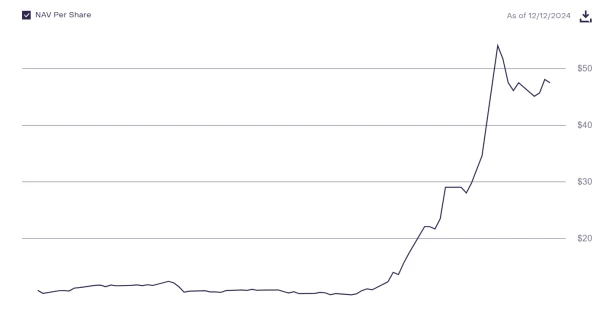

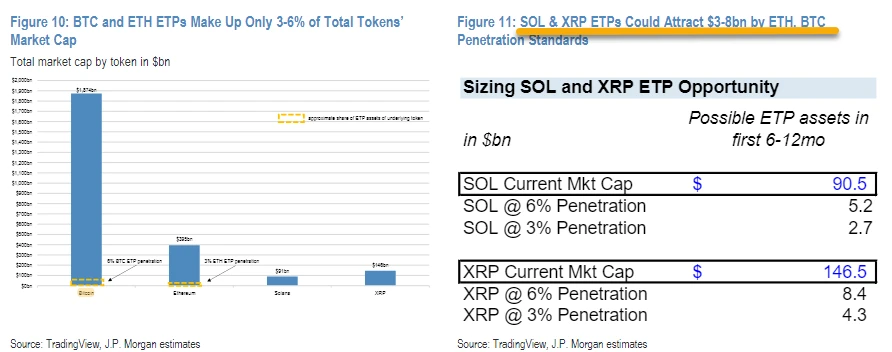

Brazil has beaten the United States to launch the first-ever spot XRP ETF, unlocking new options for the countrys investors.Prominent asset manager Hashdex has launched the XRP spot exchange-traded fund (ETF) on Brazils B3, the country's largest stock exchange and the largest in Latin America. The funds, which debuted on April 25, would provide investors with alternative exposure to the XRPL native token.XRP ETF Enters the Latin America MarketXRP is the third-largest cryptocurrency by market capitalization, excluding stablecoins, with a current value of $125 billion. Despite its prominence in the crypto space, regulatory hurdles, along with other setbacks, have prevented the debut of a spot ETF tracking its performance until now.Notably, Hashdex has now launched the product in Brazil, putting all other countries under pressure. Launched under the ticker XRPH11, the fund will track XRPs price changes using the Nasdaq XRP Reference Price Index.Furthermore, Hashdex will issue the Hashdex Nasdaq XRP Fund de Indices, while Brazils notable financial service platform Genial Investimentos will manage the funds. Hashdex tapped Genial Bank SA as the ETF's custodian.Remarkably, Hashdex will invest at least 95% of the funds assets directly or indirectly in XRP through futures contracts, securities, and other forms of exposure referencing the Nasdaq Reference Price Index. Hasdex Expanding Its Reach in BrazilNotably, the fund launched yesterday after the Brazilian Securities and Exchange Commission (CVM) gave its regulatory nod in February. Notably, the securities watchdog also recently approved Hashdexs Solana spot ETF.With the launch, the Hashdex Nasdaq XRP Fund de Indices becomes the asset managers ninth ETF trading on the B3 stock exchange. Hashdex already offers ETFs of prominent crypto assets, including Bitcoin, Ethereum, and Solana.Meanwhile, the XRP ETFs annual management cost stands at 0.8%. The funds will charge investors a maximum global yearly fee of 0.7% and 0.1% in custodian fees. However, there is zero structuring fee for the funds.The United States Under Pressure?Interestingly, despite XRPs nativity in the United States, there is still no spot ETF available for market users in the country, despite the recent introduction of a leveraged ETF product last week. In fact, Ripple, a cross-border payment financial firm affiliated with the XRP ecosystem, recently made progress in settling a regulatory dispute with the US Securities and Exchange Commission (SEC).Following the dark regulatory clouds that covered the US before now, Donald Trumps administration is set to make a difference. After vowing to make America the crypto capital of the world, his tenure has introduced measures pushing for regulatory clarity in America, sparking an altcoin ETF application frenzy from prominent asset managers.For context, Grayscale and Franklin Templeton, among others, have filed for XRP spot ETFs as the regulatory landscape continues to become more favorable. With Brazil taking the lead with the launch, the United States might be keen on joining the parade next to keep investors with an appetite for exposure to the product.Meanwhile, according to crypto prediction platform Polymarket, the odds of an XRP launch in the United States stand at 73%.